What Your Bookkeeper Must Close Before Tax Filing: P&L, Balance Sheet & Tie-Outs

What your bookkeeper must close before we file higlights:

Reconcile everything first: bank, credit card, merchant accounts → $0 difference.

Clear “holding” buckets: Undeposited Funds, Suspense, Uncategorized, Ask My Accountant.

Payroll mapping check: gross on P&L; withholdings and employer taxes posted correctly to liabilities.

Build a preliminary trial balance, post adjustments (depreciation, interest, accruals/deferrals, inventory/COGS, bad debt), then rerun an adjusted TB.

Balance sheet tie-outs are mandatory: cash, AR/AP agings, inventory, fixed assets, debt/leases, payroll liabilities, sales/use tax, equity/retained earnings.

Inventory: count, valuation memo, and COGS tie-out saved in the file.

Fixed assets: rollforward additions/disposals; depreciation schedule ties to the GL.

Loans/leases: tie to statements; split principal vs. interest properly.

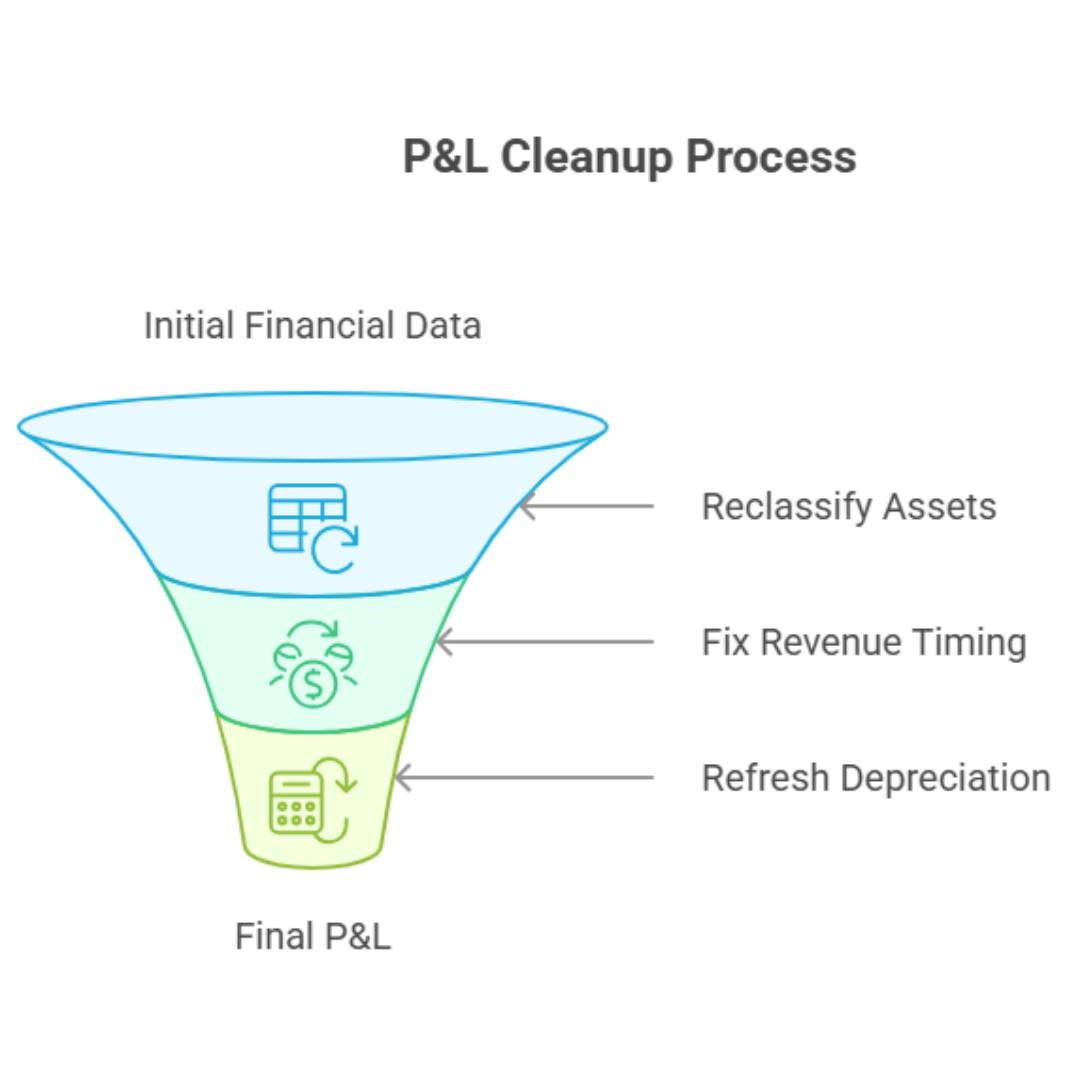

P&L cleanup after BS ties: reclass capex, fix processor revenue timing, refresh depreciation.

Book-to-tax checklist: confirm cash vs. accrual method, Section 179/bonus choices, and note permanent/temporary differences.

Handoff packet to the tax pro: adjusted TB (PDF+CSV), all reconciliations, AR/AP agings, fixed asset rollforward, inventory memo, loan/lease statements, payroll & sales tax filings, equity rollforward, W-9/1099 list, and a short judgments memo.

Timeline: Wk1 recons → Wk2 adjustments & tie-outs → Wk3 P&L + book-to-tax → Wk4 review & e-file.

Common fixes: unbalanced BS (recheck TB), retained earnings off (roll prior-year balances), loan interest/principal mixed, negative payroll liabilities, stuck Undeposited Funds.

Tools: Lock the period (QuickBooks). Complete period-close tasks/approvals (NetSuite).

Next step: Send the adjusted TB and last bank rec for a quick pre-tax close review.

If we file using messy books, the IRS sends love letters later. I run a tight tax close process: reconcile everything, build a clean trial balance, post closing entries, tie out the balance sheet, then finalize the P&L close. Do that, and tax filing prep is smooth. This sequence prevents unwanted notices and rework.

What you’ll learn:

A practical bookkeeper checklist you can hand off today: month-end close → year-end close → tie-outs → handoff packet. I’ll show you how to spot issues fast and provide a return-ready file to provide your tax preparer.

2) Trial Balance & Adjusting Entries (The Skeleton)

Debt, leases, payroll & tax: Tie loan and lease balances to lender statements; split principal vs interest correctly. Reconcile payroll liabilities to W-2/W-3/941/940 and state filings. Match sales/use tax payable to filed returns.

Equity & retained earnings: Bring forward prior-year balances; retained earnings reconciliation at year-end should show the roll from opening to current. If something doesn’t tie, trace it now.

Action Box — Tie-outs: What to do now → tick-and-tie each BS line to third-party proof (statements, agings, schedules). Docs → AR/AP aging reports, loan/lease statements, fixed asset rollforward, payroll & sales tax filings.

Make it stand out

3) Balance Sheet Tie-Outs (Prove Every Line)

Equity & retained earnings: . Verify beginning balances against the prior return and TB. Bring forward prior-year balances; retained earnings reconciliation at year end should show the roll from opening to current. If something doesn’t tie, trace it now.

Action Box Tie-outs: What to do now → tick-and-tie each BS line to third-party proof (statements, agings, schedules). Docs → AR/AP aging reports, loan/lease statements, fixed asset rollforward, payroll & sales tax filings.

Make it stand out

4) P&L Cleanup (After the BS Is Solid)

P&L cleanup: After the BS ties into the P&L, the profit and loss close is quickly accomplished. Reclassify asset purchases mis-booked to expense. Fix revenue from processors, apply capitalization policy, refresh depreciation.

Action Box - P&L: Steps → reclassify expensed capital assets, fix merchant revenue timing, refresh depreciation. Output → final P&L for the pre-close financial statements review.

Make it stand out

5) Book-to-Tax Checks (So the Return Matches Reality)

Book-to-tax checks: Confirm accounting method, cash vs accrual for this filing. Make Section 179/bonus calls. Note permanent vs temporary differences (meals, penalties, reserves). Prep a book-to-tax adjustments checklist for small businesses.

Entity nuances: Basis schedules and distributions must agree with equity activity.

For S-corps and partnerships, use a closing checklist for S-corp tax return or closeout steps for LLC/partnership tax filing. Equity rolls over differently; so do distributions and basis.

(6) The Handoff Packet (What I Need From Your Bookkeeper)

Handoff packet: At tax filing time I need one folder titled Tax Filing Prep / Year-End Bookkeeping Close with: adjusted TB (PDF+CSV), bank/CC reconciliations, AR/AP agings, fixed asset/depreciation rollforward, inventory memo, loan/lease statements, payroll & sales tax filings, equity rollforward, W-9 list and 1099 vendor review notes, plus a short memo of judgments.

Make it stand out

7) Timeline & Roles (Who Does What, When)

Week 1: Recons + housekeeping → preliminary TB

Week 2: Adjusting entries → adjusted TB → balance sheet tie-outs

Week 3: P&L cleanup → book-to-tax mapping → build handoff packet

Week 4: Tax pro review → questions → Tax return prep/approval→ e-file

Make it stand out

Common pitfalls:

Unbalanced BS, retained earnings incorrect, interest/principal mixed, negative payroll liabilities, Undeposited Funds stuck. Fix by re-running the TB, tying to statements, and removing duplicate entries.

-

Yes. The month-end close process for tax prep keeps cash and liabilities right; year-end goes faster.

-

Run a 1099 vendor review and W-9 collection checklist each December; match 1099-K and 1099-NEC totals to books.

-

Finish the balance sheet tie-out to Form 1120 or 1065, then map P&L lines. When the balance sheet ties, the P&L falls in line.

-

Use a closing checklist for S-corp tax return or closeout steps for LLC/partnership tax filing equity rolls over differently.