E-Filing 1040 and 1040-NR: Common rejects and quick fixes

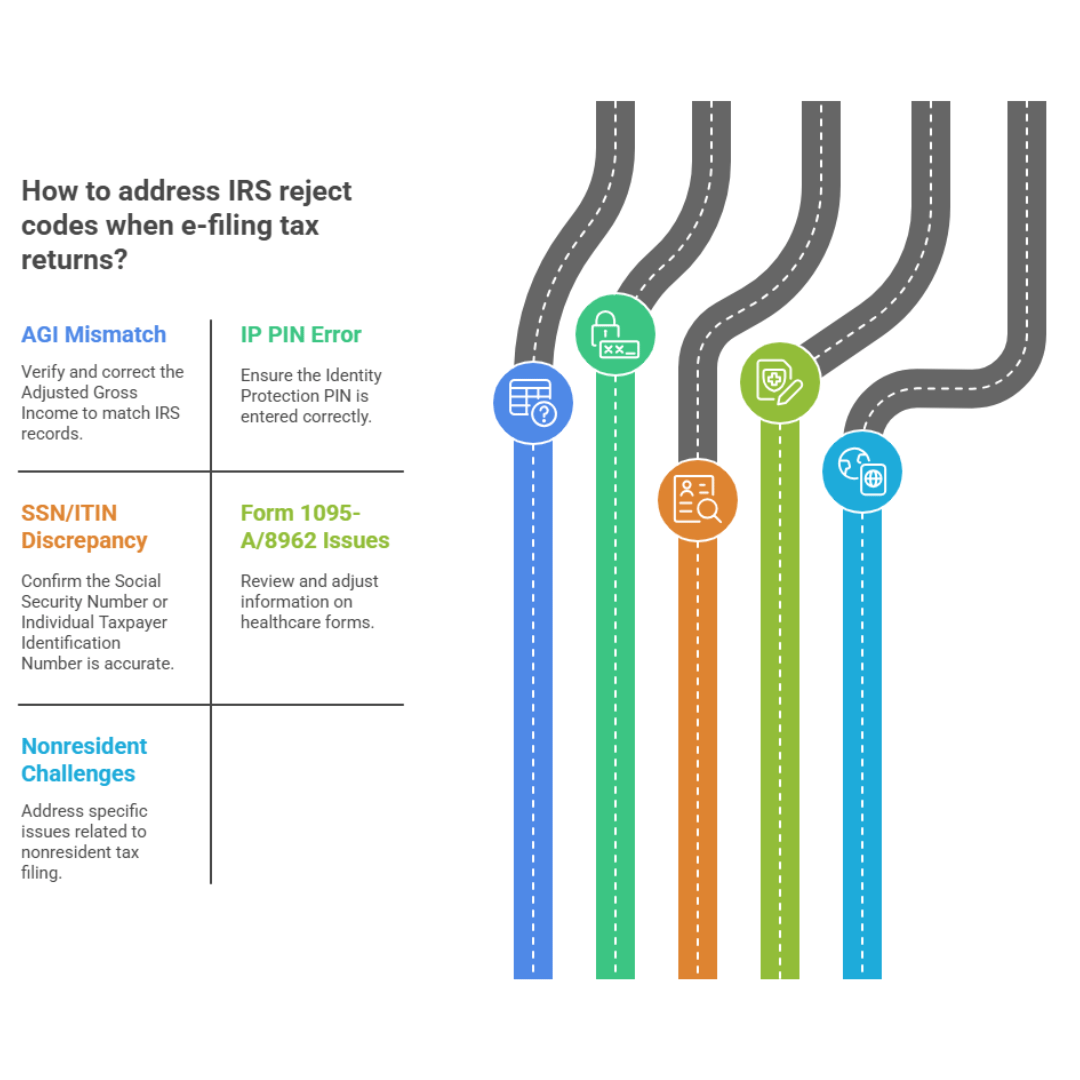

If your e-file got rejected, take a breath. I fix these every day. Below I’ll show you how to read IRS reject codes, fix the problem, and successfully re-submit. This applies to both Form 1040 and 1040-NR and covers AGI mismatches, IP PIN errors, SSN or ITIN mismatches, Form 1095-A and 8962 issues, and more.

Key Takeaways

The #1 reject is a prior-year AGI or PIN mismatch (IND-031-04 / IND-032-04).

If last year’s return wasn’t processed or you didn’t file, entering $0 for prior-year AGI is correct per IRS guidance.

If anyone on the return has an IP PIN, the exact 6-digit PIN must be included, or your e-file will be rejected. You can retrieve or opt in for one at IRS.gov.

Marketplace (Form 1095-A) filers must include Form 8962. Missing it triggers an automatic reject (F8962-070).

Name, SSN, or DOB mismatches are usually typos or Social Security mismatches. Correct the info and try again.

Starting with the 2025 filing season, the IRS can accept a second return claiming a dependent if the second filer includes a valid IP PIN; otherwise, the duplicate claim still rejects electronically.

Who This Guide Is For

U.S. taxpayers filing Form 1040 and nonresidents filing Form 1040-NR, including ITIN holders, treaty filers, and those with foreign addresses. I’ll note 1040-NR specifics like Schedule OI, treaty statements, and address formatting.

Make it stand out

Before You Hit “Resubmit” Quick Prep Checklist

Pull last year’s return and confirm Form 1040, line 11 (AGI). If last year wasn’t processed or you didn’t file, $0 can be correct for prior-year AGI.

Gather IP PINs (you, spouse, dependents). Retrieve or opt in via your IRS Online Account; dependents can be eligible.

Triple-check names, SSNs, DOBs against Social Security cards; fix typos.

If you had Marketplace coverage, grab Form 1095-A and include Form 8962.

1040-NR: verify ITIN status, treaty positions, Schedule OI items, and use the correct 1040-NR schedules (not 1040’s versions).

Filing tools: IRS Free File is available to many taxpayers each year.

Top 5 IRS Reject Codes & Fixes

1. Prior-Year AGI / PIN Mismatch (IND-031-04 / IND-032-04)

Why it happens: the AGI or PIN doesn’t match IRS records.

Fix: Use the exact AGI from your prior return. If it wasn’t processed or never filed, use $0 as allowed.

2. Missing or Incorrect IP PIN (IND-180 / 181 / 995 / 996)

Why it happens: anyone with an IP PIN must enter that 6-digit code.

Fix: Retrieve the current-year PIN from your IRS Online Account and update before resubmitting.

3. Name / SSN / DOB Mismatch

Why it happens: typos, recent name changes, or a dependent already claimed elsewhere.

Fix: Match to Social Security records exactly. If a dependent was already claimed, you may need to mail the return (unless you have a valid IP PIN for dependent in 2025).

4. Missing Form 8962 for 1095-A Filers (F8962-070)

Why it happens: Marketplace coverage was reported without reconciliation.

Fix: Add Form 8962 and resubmit.

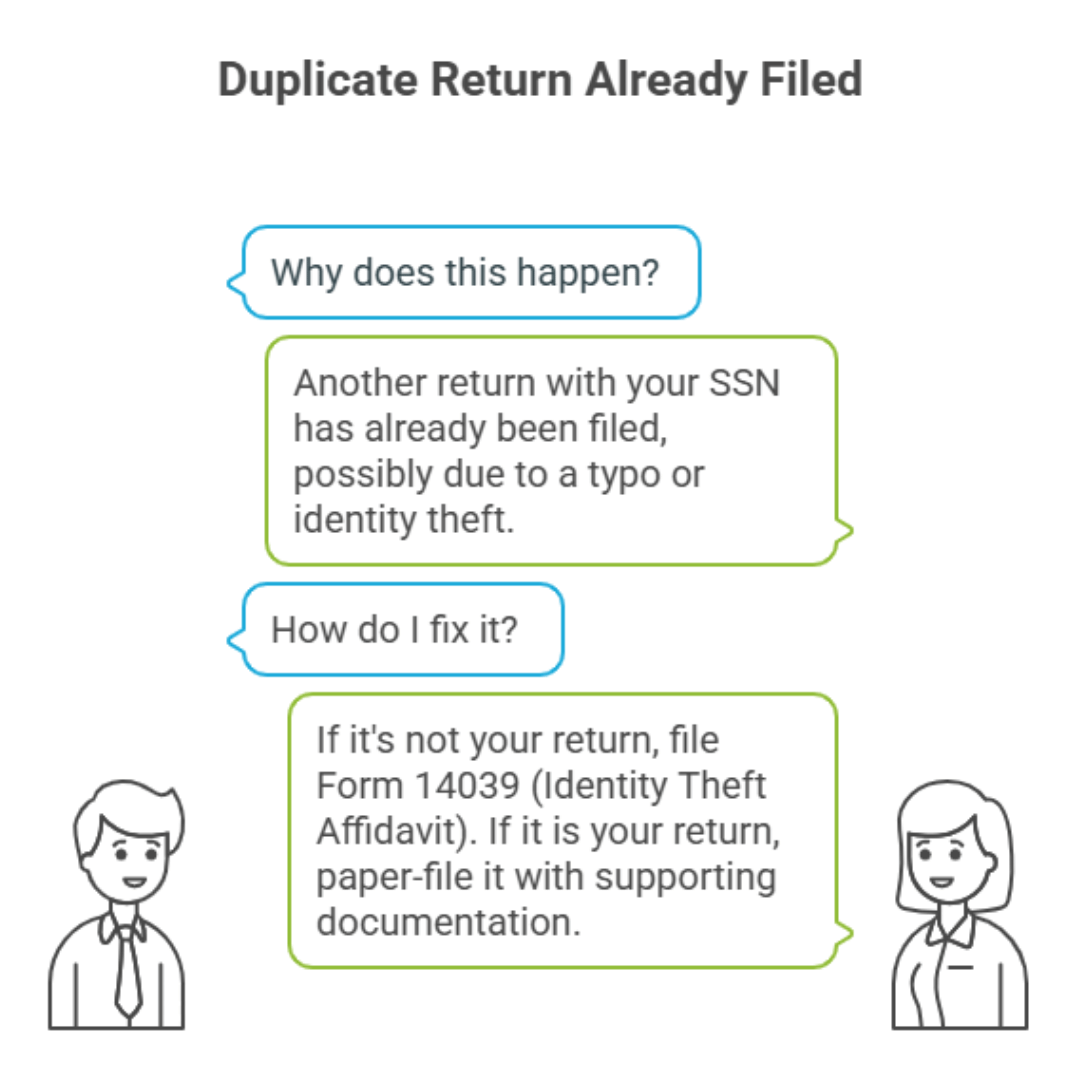

5. Duplicate Return Already Filed

Why it happens: another return under your SSN is on file (could be a typo or ID theft).

Fix: If not your return, file Form 14039 for ID theft. If it is yours, paper-file with supporting docs.

1040-NR: Nonresident-Specific Rejects (What to Check

ITIN not valid/expired → renew or correct before e-filing; if timing is tight, you may need to mail the return with W-7/renewal.

Treaty claims → verify treaty article and include any required statement/forms; many rejects tie back to missing or invalid treaty details.

Schedule OI & correct schedules → complete Schedule OI and use 1040-NR schedules (not 1040’s). The IRS warns against mixing schedules across forms.

Foreign address formatting → follow the 1040-NR instruction format and abbreviations; re-file.

When to Stop Re-E-Filing and Mail It

After one or two careful resubmissions, paper-file if:

It’s a duplicate return or dependent conflict with no IP PIN path, or

IRS guidance specifically requires mailed documents.

Attach the reject notice and any supporting forms like Form 8948 (if prepared by a professional).

Free Filing Options

IRS Free File offers guided software for many taxpayers each year. If you exceed income limits, use Free File Fillable Forms at IRS.gov.

Pro Tips From a Tax Pro

Keep a secure copy of last year’s return and transcripts before e-file season; it speeds AGI mismatch fixes.

If you’ve had dependent-claim conflicts, enroll for IP PINs ahead of time to avoid duplicate return rejected trouble.

Set a policy: if a return rejects twice for the same reason, switch to paper with a short cover note and required attachments (saves time).

-

Description text goes here

-

Retrieve or opt in through your IRS Online Account and resubmit.

-

Match to the card exactly. If a dependent was claimed elsewhere, see IRS guidance or mail the return.

-

Yes, attach Form 8962 or explanation and re-e-file.

-

Expired ITINs, missing treaty details, missing Schedule OI, or using 1040 schedules by mistake.

Want help?

If you’d like me to handle the reject code review, fix the entries, and submit the corrected 1040 or 1040-NR, I’ll take it off your plate, start with a quick transcript + notice check and we’ll move fast.

Body